Financial Reserves 1.03

Effective Date: 3/6/2020

Subject: Financial Reserves

Category: Financial Management 1.03

1. Purpose

The Financial Reserves Policy is designed to protect the long-term financial health of campuses of the System and to meet the following objectives:

- Maintain adequate liquidity needs for daily operations at levels sufficient for accreditation and rating agencies

- Prepare for infrastructure investments in capital projects and planned maintenance projects

- Create capacity for planned strategic investments

2. Definition of Reserve Funds

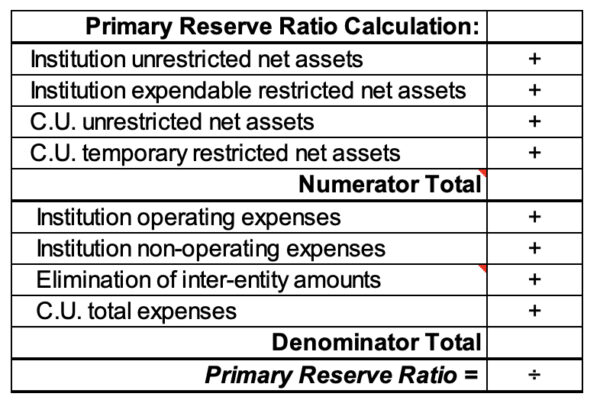

Unrestricted Operating Reserves: Each campus shall build and maintain an adequate level of cash and unrestricted net assets to support daily operations in the event of unanticipated shortfalls. During annual budget planning, the Unrestricted Operating Reserves Fund shall not be utilized for ongoing budgetary commitments or to cover a permanent loss of restricted funds without recommendation from the President of the ASU System. Annually, the basis for determining an adequate reserve level will be the Primary Reserve Ratio (PRR), which is the level of expendable net assets divided by total expenses using audited financial statement information. Campuses should work to establish and maintain unrestricted operating reserves (cash available within the operating funds) from .25 to .50 PRR.

Below is the calculation for the PRR:

Facilities Maintenance, Renovation, and Construction Reserves: Each campus will be required annually to budget and transfer an amount approved by the Board of Trustees for the purpose of facilities maintenance needs. Beyond set-aside for repairs and maintenance, campuses are encouraged to develop reserves for renovation, improvement, and construction of facilities to lessen the need to issue long-term debt.

Strategic Investment Reserves: Campuses are encouraged to create and maintain strategic investment reserves. These reserves may be established to fund initiatives that support the campus initiatives and priorities, including seed monies for new academic program development or existing program enhancement, research and equipment investments, campus programs, construction, and other expenditures that support planned goals.

Maintaining Adequate Reserves and Liquidity

Because it is essential for the financial health of both the System and campus to maintain adequate reserves and liquidity, any campus that ends the prior fiscal year with Unrestricted Operating Reserves less than a .25 PRR shall make that fund the highest priority for replenishment. Additionally, campuses shall maintain liquidity to adequately cover its cash operating expenses for a minimum of 60 days.

Below is the calculation for Days of Cash on Hand:

Any campus at less than .10 PRR, or with less than 60 days cash on hand, will be considered in financial distress and will be subject to additional monitoring by the System Administration until the campus achieves the target level in accordance with this policy.

1 C.U. is Component Unit such as a related foundation excluding athletic-related or alumni foundations.

2 SNP is Statement of Net Position from the audited financial statements.

3 SRECNP is Statement of Revenues, Expenses and Changes of Net Position from the audited financial statements.

(Adopted by the Arkansas State University Board of Trustees on March 6, 2020, Resolution 20-01.)